What is Fintology?

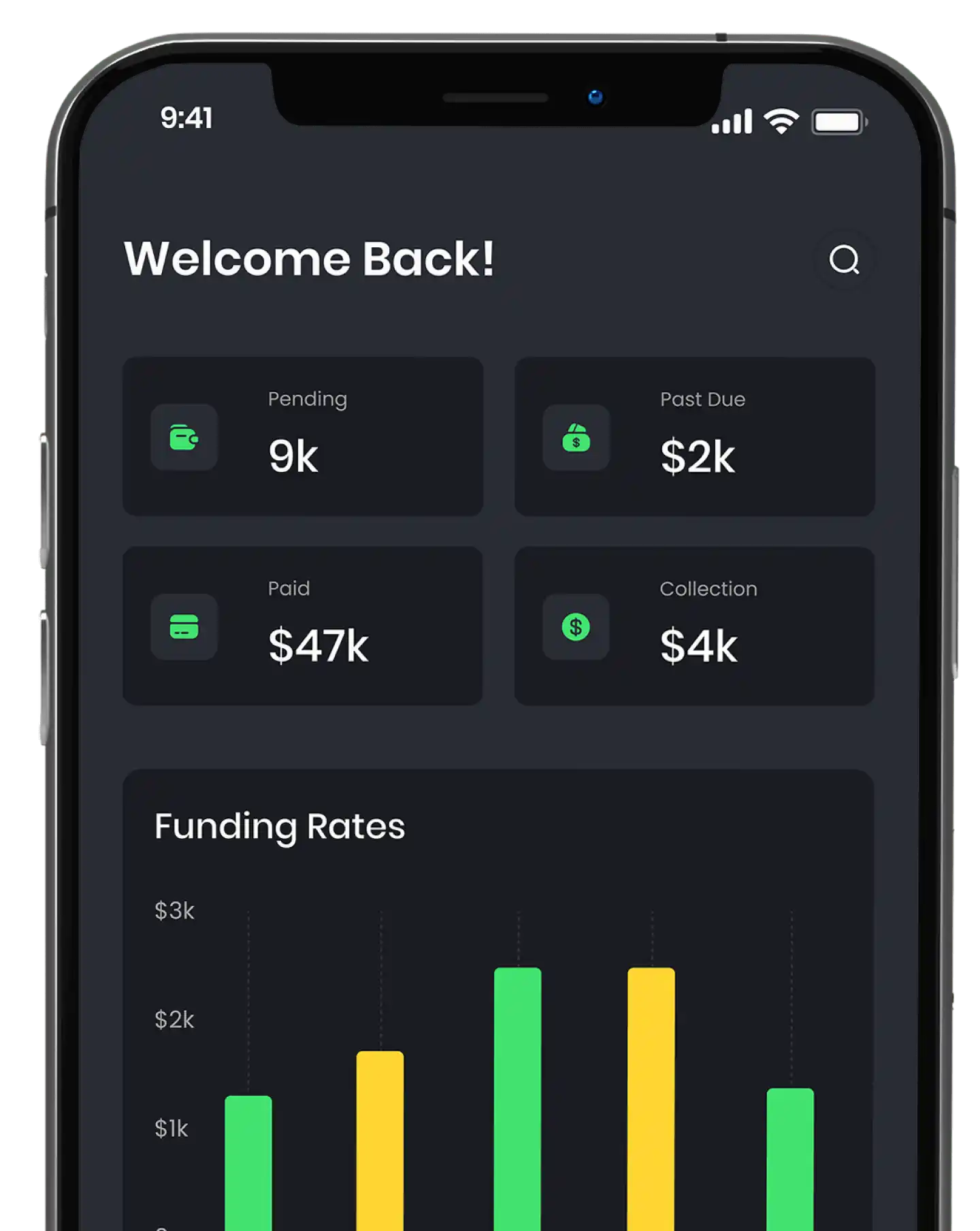

Fintology for Businesses & Consumers at a Glance

No need to hassle through multiple lending programs.

Access to over thousands of different lending and financial products.

Never worry about being financial resources ever again.

No matter your industry our AI technology knows what to deliver.

How Do I Get Started

Go through our simple 2 minute application process.

1

Get pre qualified access to your AI powered lending products through a soft check inquiry.

3

Success! now you are ready to launch forward and offer your clients the best lending experience possible.

5

2

Determine if you want access Business and/or Personal capital.

4

Opt In to gain additional services such as Tax & Insurance Strategy to access capital regardless of your credit score

The Problem

How it Works

The Solution with Our Smart Adaptive AI Technology

State of the art Infrastructure & Security

-

All data is encrypted internally with field level encryption applied to sensitive data elements.

-

With Fintology, you can set aside concerns about compliance, licenses, insurance, or legal matters. We prioritize the security, safety, and compliance of every client, regardless of their business niche.

-

No need to worry of data breaches or information compromise anymore.

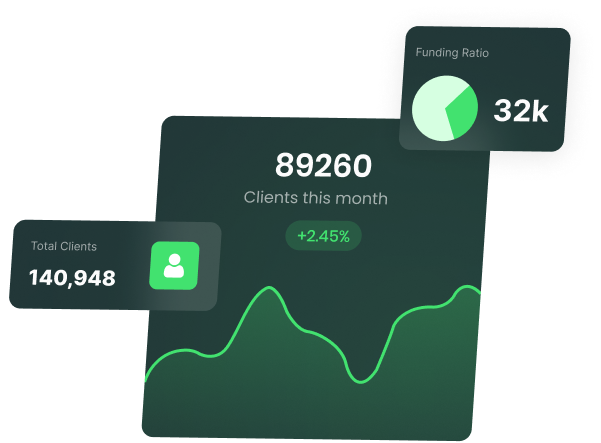

Unrivaled Customer Experience

Fintology offers consumers an all-in-one solution that provides both ease of use and peace of mind.

More than your Score

-

Fintology goes beyond consumer credit scores by leveraging diverse data sources, including geographical and economic data, as well as proprietary systems. This holistic approach enables us to identify the most suitable lending products within your industry or niche.

-

Discover your exact financing needs within minutes, without the labor- and time-intensive process of searching for the best financing solutions available to you.

Ready for a 100% Free Demo?

Sign up today and see why Fintology is the best AI lending solution for you and other consumers nationwide!